Managing money can feel difficult when your income is small. Many people believe wealth management is only for rich individuals. This is not true. Wealth management is for everyone, even beginners with limited income.

Wealth management simply means using your money in a smart way. It helps you save, plan, grow, and protect your finances over time. You do not need a high salary to start. You only need the right habits and clear goals.

This guide explains simple wealth management strategies for beginners. The language is easy. The steps are practical. Anyone can follow them.

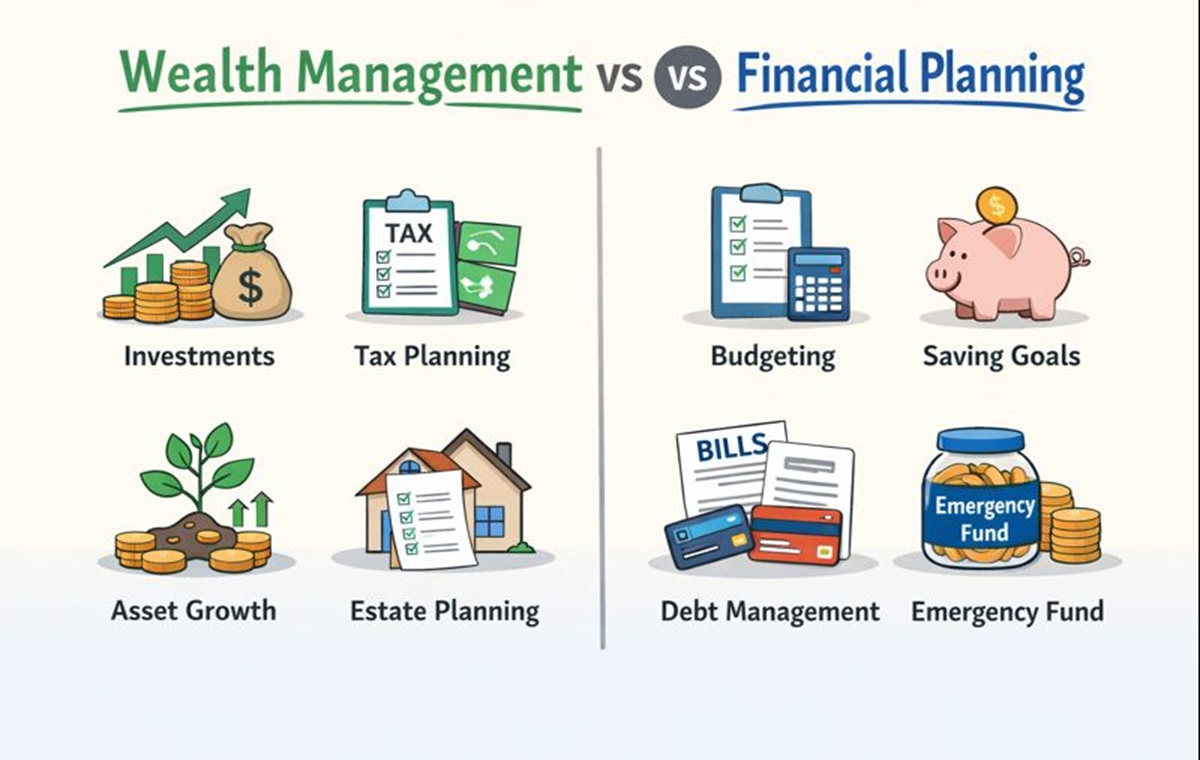

What Is Wealth Management?

Wealth management is the process of handling your money wisely. It includes saving, spending, investing, and planning for the future.

It helps you:

- Control your money

- Reduce financial stress

- Prepare for emergencies

- Build long-term security

Wealth management is not about getting rich quickly. It is about making steady and smart decisions with the money you have.

Why Wealth Management Matters for Small Income Earners

When income is small, every amount matters. Poor money choices can create debt and stress. Good wealth management helps you avoid these problems.

Benefits include:

- Better control over expenses

- Less dependency on loans

- Improved financial confidence

- Stronger future planning

Even small savings can grow with time if managed correctly.

Step 1: Understand Your Income and Expenses

Before managing wealth, you must know where your money comes from and where it goes.

Track Your Monthly Income

Write down:

- Salary

- Freelance earnings

- Side income

- Any other sources

Use real numbers. Do not guess.

Track Your Expenses

List all expenses, such as:

- Rent

- Food

- Transport

- Bills

- Phone and internet

- Entertainment

Tracking helps you see spending habits clearly.

Step 2: Create a Simple Budget

A budget is a plan for your money. It tells your money what to do instead of wondering where it went.

Basic Budget Rule for Beginners

A simple method is:

- Spend on needs first

- Save a small portion

- Limit unnecessary spending

Even saving a small amount is better than saving nothing.

Keep Budget Flexible

Do not make strict budgets that are hard to follow. A flexible budget works better and reduces stress.

Step 3: Start Saving With Small Amounts

Many beginners think they must save large sums. This is wrong.

Why Small Savings Matter

Small savings:

- Build discipline

- Create emergency protection

- Grow with time

Saving is a habit, not a number.

Easy Saving Tips

- Save before spending

- Set aside money weekly

- Use a separate savings account

- Avoid touching savings for daily needs

Consistency is more important than size.

Step 4: Build an Emergency Fund

An emergency fund is money saved for unexpected events.

These events may include:

- Medical expenses

- Job loss

- Urgent repairs

- Family emergencies

How Much to Save

Start with a small target, such as one month of basic expenses. Increase it slowly over time.

This fund protects you from debt during difficult situations.

Step 5: Control and Reduce Unnecessary Spending

Unnecessary spending silently damages wealth.

Identify Wants vs Needs

Needs are essentials like food and housing. Wants are extras like luxury items or frequent dining out.

Reducing wants does not mean living poorly. It means spending wisely.

Simple Spending Control Tips

- Avoid impulse buying

- Compare prices before buying

- Limit subscription services

- Plan purchases in advance

Small changes can create big savings.

Step 6: Avoid High-Interest Debt

Debt can slow wealth growth, especially high-interest debt.

Examples include:

- Credit card debt

- Payday loans

- Unplanned borrowing

Smart Debt Management

- Pay high-interest debt first

- Avoid borrowing for non-essential items

- Pay bills on time

Using debt carefully protects your financial future.

Step 7: Learn Basic Investing Concepts

Investing helps money grow over time. Beginners do not need advanced knowledge.

Key Investing Principles

- Start early

- Invest small

- Be patient

- Avoid quick-profit schemes

Investing is not gambling. It is a long-term strategy.

Beginner-Friendly Approach

Learn slowly. Understand basic options before investing. Never invest money you cannot afford to lose.

Step 8: Focus on Long-Term Goals

Wealth management is not about quick results. It focuses on long-term stability.

Examples of Financial Goals

- Buying a home

- Education planning

- Retirement security

- Debt-free living

Clear goals guide your money decisions and keep you motivated.

Step 9: Improve Financial Knowledge Gradually

Financial education helps you make better choices.

Easy Ways to Learn

- Read beginner finance articles

- Follow trusted finance blogs

- Watch educational videos

- Use budgeting apps

Learning step by step prevents confusion and mistakes.

Step 10: Increase Income When Possible

While managing expenses is important, increasing income can speed progress.

Simple Income Growth Ideas

- Learn new skills

- Take freelance work

- Offer services online

- Improve career skills

Higher income combined with good management creates stronger financial stability.

Step 11: Protect Your Money

Protection is an important part of wealth management.

Basic Protection Steps

- Save emergency funds

- Avoid financial scams

- Keep personal financial data secure

- Understand financial agreements before signing

Protection prevents loss and keeps progress steady.

Step 12: Stay Patient and Consistent

Wealth management takes time. Results do not appear overnight.

Why Patience Matters

- Small actions grow slowly

- Consistency builds success

- Long-term thinking reduces mistakes

Stay focused. Trust the process.

Common Wealth Management Mistakes Beginners Should Avoid

Beginners often make avoidable mistakes.

Common Errors

- Not tracking spending

- Ignoring savings

- Chasing quick profits

- Overspending on lifestyle

- Avoiding financial planning

Avoiding these mistakes protects your progress.

Simple Wealth Management Plan for Beginners

Here is a simple plan anyone can follow:

- Track income and expenses

- Create a basic budget

- Save small amounts regularly

- Build an emergency fund

- Control unnecessary spending

- Avoid high-interest debt

- Learn investing basics

- Focus on long-term goals

This plan works for small income earners.

Final Thoughts

Wealth management is not only for the rich. It is for everyone who wants financial peace and stability.

Even with a small income, you can manage your money wisely. Start small. Stay consistent. Learn gradually.

Simple habits create strong financial foundations. Over time, these habits lead to better control, less stress, and a more secure future.

The best time to start wealth management is today.