Managing money wisely is important for everyone. A stable and secure future depends on how well you plan, save, and use your money today. Wealth management is not only for rich people. It is for anyone who wants financial peace, security, and long-term stability.

In this article, you will learn the best wealth management tips in very simple language. These tips will help you protect your money, grow it slowly, and avoid financial stress in the future.

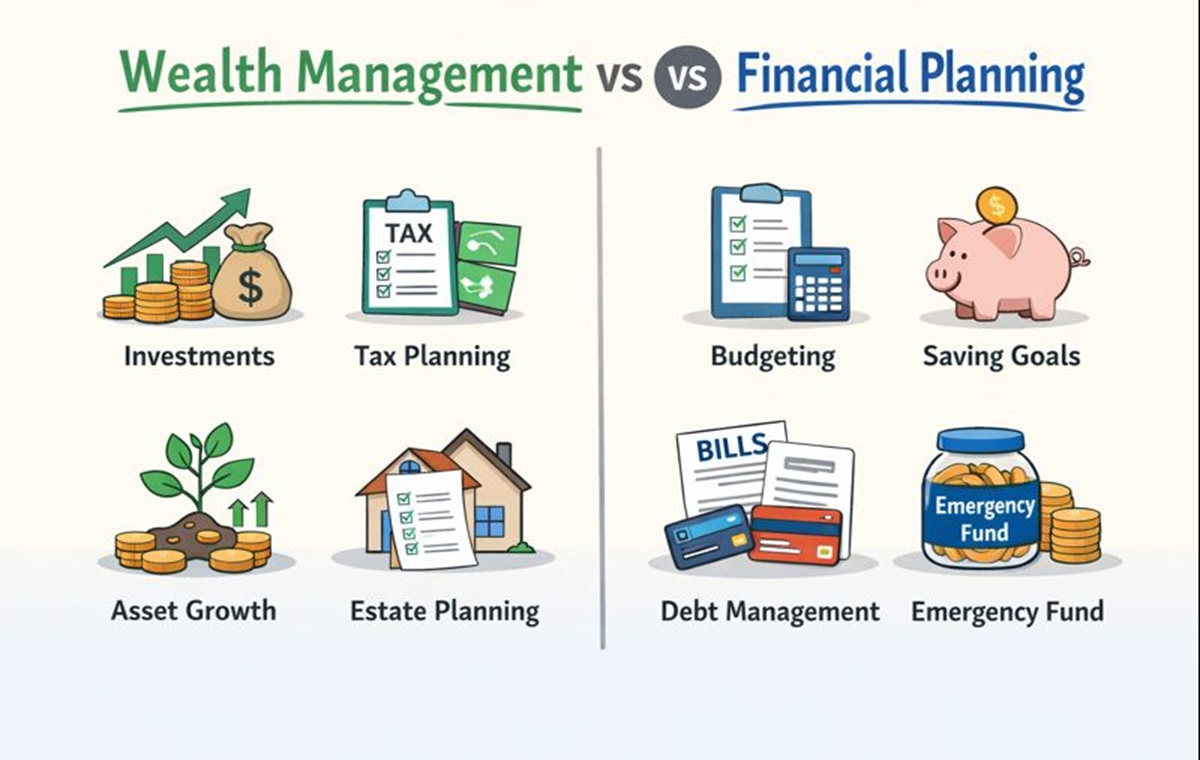

What Is Wealth Management?

Wealth management means planning and handling your money in a smart way. It includes saving, spending, investing, and protecting your income. The goal is to build wealth over time and stay financially secure.

Wealth management is not about quick profits. It is about steady growth and long-term safety. Anyone can practice wealth management, even with a small income.

Why Wealth Management Is Important for the Future

Good wealth management helps you prepare for unexpected situations. Life can bring job loss, medical bills, or emergencies at any time. When your money is managed properly, you feel more confident and less stressed.

It also helps you achieve long-term goals. These goals may include buying a home, supporting your family, or enjoying retirement without money worries.

1. Set Clear Financial Goals

The first step in wealth management is setting clear goals. Without goals, money has no direction.

Your goals should be simple and realistic. For example, saving for emergencies, buying a house, or planning for retirement. Write your goals down and give each one a time frame.

Clear goals help you stay focused. They also help you avoid unnecessary spending.

2. Understand Your Income and Expenses

You must know how much money comes in and how much goes out every month. This is the base of strong wealth management.

List all your income sources. Then list your monthly expenses such as rent, food, bills, and transport. This helps you see where your money is being used.

When you understand your spending, it becomes easier to control it and save more.

3. Create a Simple Budget

A budget is a simple plan for your money. It helps you spend wisely and save regularly.

Your budget should include essentials first. These include food, housing, and utilities. After that, set aside money for savings. The remaining amount can be used for personal needs.

A budget does not mean cutting all enjoyment. It means spending smartly while keeping your future safe.

4. Build an Emergency Fund

An emergency fund is very important for financial security. It protects you during sudden problems like medical emergencies or job loss.

Try to save at least three to six months of basic expenses. Keep this money in a safe and easily accessible account.

This fund helps you avoid debt and stress during difficult times.

5. Save Regularly, Even Small Amounts

Saving regularly is more important than saving large amounts once in a while. Small savings grow over time.

Set a fixed amount to save every month. Treat savings like an important bill that must be paid first.

Over time, regular saving builds strong financial discipline and stability.

6. Avoid Unnecessary Debt

Debt can slow down your wealth growth. Not all debt is bad, but unnecessary debt should be avoided.

High-interest loans and credit cards can harm your finances. Always think before borrowing money. Ask yourself if it is truly needed.

Pay your bills on time to avoid extra charges and financial pressure.

7. Invest With a Long-Term View

Investing helps your money grow over time. It is an important part of wealth management.

You do not need to take high risks. Choose investments that match your comfort level. Long-term investing usually provides better stability than short-term decisions.

Always understand where your money is going. Never invest in something you do not understand.

8. Diversify Your Money

Do not put all your money in one place. Diversification means spreading money across different options.

This reduces risk and protects you from major losses. If one option performs poorly, others can balance it.

Diversification is a key rule for a stable and secure financial future.

9. Protect Your Wealth With Insurance

Insurance is an important part of wealth management. It protects your money from unexpected losses.

Health insurance helps cover medical expenses. Life insurance supports your family in difficult times. Property insurance protects valuable assets.

Insurance gives peace of mind and financial safety.

10. Control Lifestyle Inflation

Lifestyle inflation happens when spending increases with income. When people earn more, they often spend more.

Try to control this habit. Increase savings when income increases. Do not increase expenses too quickly.

Living below your means helps you build wealth faster and more securely.

11. Plan for Retirement Early

Retirement planning should start as early as possible. The earlier you start, the easier it becomes.

Even small monthly contributions can grow over time. Planning early reduces pressure later in life.

A good retirement plan helps you live comfortably without depending on others.

12. Keep Track of Your Financial Progress

Review your financial plan regularly. This helps you see what is working and what needs improvement.

Check your savings, investments, and expenses at least once a year. Adjust your plan if your income or goals change.

Regular review keeps your wealth management strategy strong and updated.

13. Avoid Emotional Financial Decisions

Emotions can lead to poor money decisions. Fear and greed often cause financial mistakes.

Always make decisions based on logic and planning. Avoid rushing into financial choices.

Staying calm and informed helps protect your wealth in the long run.

14. Improve Financial Knowledge

Learning about money is very helpful. The more you understand, the better decisions you make.

Read trusted financial content. Learn basic terms related to saving, investing, and budgeting.

Financial knowledge empowers you and builds confidence.

15. Seek Professional Guidance When Needed

Sometimes, professional advice can help. A financial expert can guide you based on your situation.

Do not follow advice blindly. Make sure the guidance matches your goals and risk level.

Professional help can improve your wealth management strategy when used wisely.

Common Wealth Management Mistakes to Avoid

Many people make mistakes that slow their progress. These include not saving regularly, ignoring budgets, and taking high risks.

Another mistake is delaying planning. Waiting too long makes wealth building harder.

Avoiding these mistakes helps you stay on the right path.

How Wealth Management Creates Long-Term Stability

Wealth management is not about fast results. It builds stability slowly over time.

Good planning protects you from financial shocks. It also helps you enjoy life with less stress.

A stable future comes from smart daily choices and long-term thinking.

Final Thoughts

Wealth management is a lifelong process. It requires patience, discipline, and planning. You do not need a high income to manage wealth properly.

By setting goals, saving regularly, controlling expenses, and planning ahead, you can build a stable and secure future.

Start small, stay consistent, and focus on long-term financial health. Good wealth management today creates peace and security tomorrow.