Managing money is important for everyone.

People earn money, save money, spend money, and plan for the future.

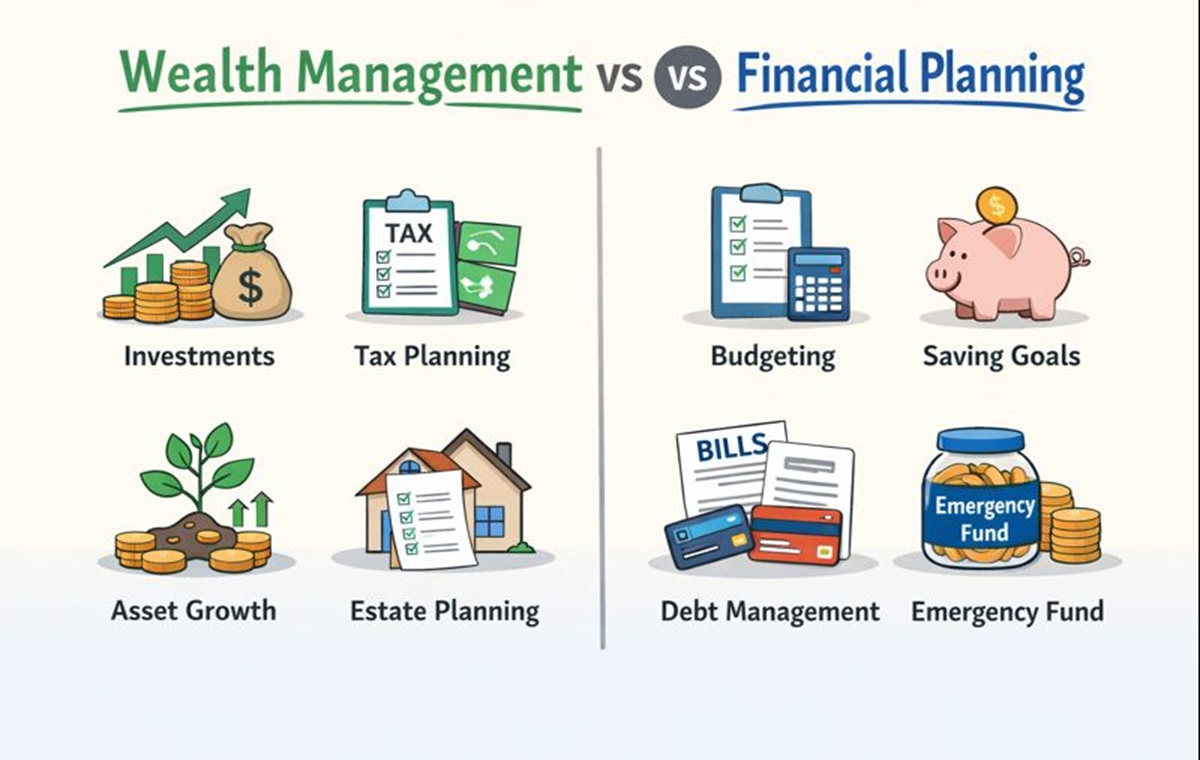

But many people feel confused when they hear terms like wealth management and financial planning.

These two terms sound similar.

But they are not the same.

In this article, you will clearly understand:

- What wealth management is

- What financial planning is

- How they are different

- Which one is right for you

- When you may need both

What Is Financial Planning?

Financial planning is about organizing your money to meet your life goals.

It helps you answer simple questions like:

- How much should I save?

- How can I manage my monthly expenses?

- How do I plan for emergencies?

- How can I prepare for the future?

Financial planning focuses on basic money management.

Main Goals of Financial Planning

The main purpose of financial planning is to help you:

- Track your income and expenses

- Create a monthly or yearly budget

- Save money regularly

- Reduce unnecessary spending

- Prepare for future needs

It gives you clear direction for your money.

What Does Financial Planning Include?

Financial planning usually covers these areas:

1. Budgeting

You learn how much money you earn and how much you spend.

This helps you control expenses.

2. Saving

You plan how much money to save every month.

This includes emergency savings.

3. Debt Management

You manage loans, credit cards, and monthly bills.

The goal is to avoid financial stress.

4. Goal Planning

You plan for goals like education, home purchase, or retirement.

Each goal has a timeline and savings plan.

Who Needs Financial Planning?

Financial planning is useful for:

- Students

- New job holders

- Families with limited income

- People starting their financial journey

- Anyone who wants better control of money

It is suitable for almost everyone.

What Is Wealth Management?

Wealth management is a broader and more advanced approach to money.

It focuses on growing, protecting, and managing wealth over the long term.

Wealth management usually combines many financial services into one plan.

Main Goals of Wealth Management

The main goal of wealth management is to:

- Grow wealth steadily

- Protect existing assets

- Manage large or complex finances

- Plan long-term financial security

It is not only about saving money.

It is also about making money work better for you.

What Does Wealth Management Include?

Wealth management may include:

1. Investment Planning

Managing investments like stocks, funds, or other assets.

The focus is long-term growth.

2. Risk Management

Reducing financial risks.

This includes insurance and protection planning.

3. Tax Planning

Managing money in a way that reduces tax impact legally.

4. Estate Planning

Planning how wealth will be passed to family members in the future.

5. Retirement Strategy

Creating long-term income plans for later life.

Who Needs Wealth Management?

Wealth management is more suitable for:

- High-income individuals

- Business owners

- People with multiple income sources

- Families with long-term assets

- People planning generational wealth

It is usually used when finances become more complex.

Key Differences Between Wealth Management and Financial Planning

Now let’s clearly understand how these two are different.

1. Scope of Services

Financial Planning

- Focuses on budgeting, saving, and basic planning

- Covers fewer financial areas

Wealth Management

- Covers investments, taxes, assets, and long-term strategies

- Has a wider and deeper scope

2. Target Audience

Financial Planning

- Designed for beginners

- Suitable for regular income earners

Wealth Management

- Designed for people with higher wealth

- Suitable for advanced financial needs

3. Time Horizon

Financial Planning

- Short-term to medium-term goals

- Focuses on current financial stability

Wealth Management

- Long-term and lifetime planning

- Focuses on future wealth growth

4. Level of Complexity

Financial Planning

- Simple and easy to understand

- Easy to manage on your own

Wealth Management

- More complex

- Often requires professional guidance

5. Focus Area

Financial Planning

- Managing money you earn

- Controlling spending and saving

Wealth Management

- Growing and protecting wealth

- Managing assets and investments

Can Financial Planning and Wealth Management Work Together?

Yes, they can work together very well.

In fact, financial planning is the foundation of wealth management.

You usually start with financial planning.

As your income and assets grow, you may move into wealth management.

Example to Understand Better

Imagine a simple journey:

- You start working

- You create a budget

- You save money

- You manage expenses

This is financial planning.

Later:

- Your savings grow

- You invest money

- You plan long-term security

- You protect your assets

This becomes wealth management.

Which One Is Right for You?

The right choice depends on your financial situation.

Choose Financial Planning If:

- You want better control of expenses

- You are starting your financial journey

- Your income is limited or fixed

- You want simple and clear money guidance

Choose Wealth Management If:

- You already have savings and assets

- You want long-term wealth growth

- Your finances are complex

- You want structured financial strategies

Common Myths About Wealth Management and Financial Planning

Let’s clear some common misunderstandings.

Myth 1: Wealth Management Is Only for the Rich

This is not completely true.

While it is more common among high-income people, anyone with growing assets can benefit.

Myth 2: Financial Planning Is Too Basic

Financial planning is very important.

Without it, wealth management cannot work properly.

Myth 3: You Must Choose Only One

You can use both at different stages of life.

They are not enemies.

They support each other.

Why Understanding the Difference Is Important

Knowing the difference helps you:

- Make better financial decisions

- Choose the right financial service

- Avoid confusion and stress

- Plan money according to your needs

It also helps you avoid using advanced services too early or ignoring basic planning.

Final Thoughts

Wealth management and financial planning both play important roles in money management.

Financial planning helps you control and organize your money.

Wealth management helps you grow and protect your wealth.

They are different, but connected.

Start with financial planning.

Move to wealth management when your finances grow.

Understanding this difference can help you build a more stable and secure financial future.