Building wealth does not mean taking big risks or gambling your money. Many people believe wealth is only for the rich or for those who invest in risky assets. This is not true. Wealth can be built slowly, safely, and smartly with the right habits and planning.

In this guide, you will learn how to build wealth step by step without taking high risks. The ideas shared here are simple, practical, and suitable for beginners. You do not need a high income to start. You only need consistency and patience.

What Does Building Wealth Really Mean?

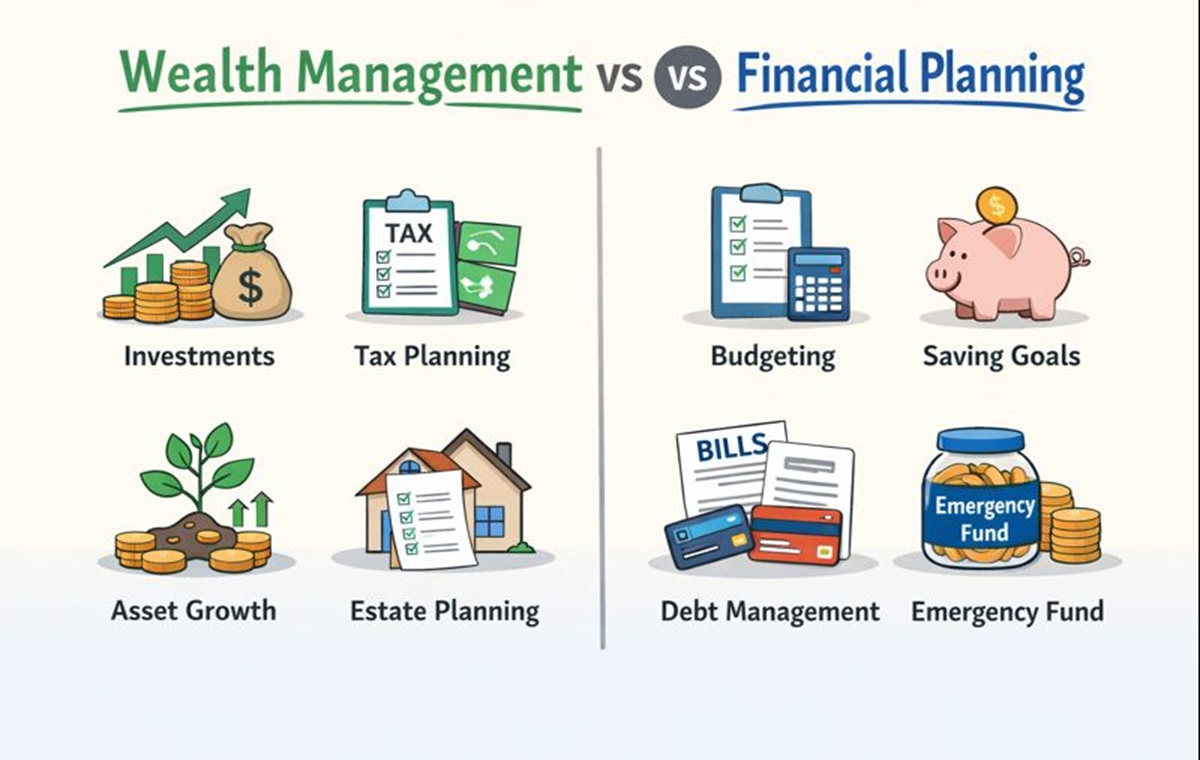

Building wealth means growing your money over time while keeping your finances stable and secure. It is not about quick profits. It is about long-term financial strength.

Wealth includes:

- Savings for emergencies

- Investments for the future

- Low or manageable debt

- Regular income growth

- Financial peace of mind

True wealth helps you handle life problems without stress.

Step 1: Build a Strong Financial Foundation

Before investing or saving large amounts, you need a strong base.

Understand Your Income and Expenses

Start by knowing:

- How much money you earn each month

- How much money you spend

- Where your money goes

Write down your expenses. This helps you see wasteful spending and improve control.

Create a Simple Budget

A budget does not mean stopping enjoyment. It means spending with purpose.

A simple budget should include:

- Daily living expenses

- Savings

- Debt payments

- Small personal enjoyment

This step reduces financial pressure and builds discipline.

Step 2: Create an Emergency Fund First

An emergency fund is one of the most important low-risk financial tools.

Why an Emergency Fund Matters

Life is unpredictable. Medical issues, job loss, or urgent repairs can happen anytime. Without savings, people often take loans or use credit cards.

An emergency fund:

- Protects you from debt

- Keeps your investments safe

- Reduces stress

How Much Should You Save?

Start small. Aim for:

- At least 3 to 6 months of basic expenses

- Keep it in a safe savings account

This money is not for spending. It is for emergencies only.

Step 3: Reduce High-Interest Debt Slowly

Debt with high interest is one of the biggest obstacles to wealth.

Focus on Bad Debt First

High-interest debt includes:

- Credit cards

- Personal loans

- Payday loans

These debts grow fast and reduce your ability to save.

Simple Debt Reduction Method

You can:

- Pay minimum amounts on all debts

- Put extra money toward the highest interest debt

- Avoid taking new unnecessary loans

Reducing debt is a risk-free way to improve your financial health.

Step 4: Start Saving Consistently

Saving money regularly builds wealth without risk.

Make Saving Automatic

Set a fixed amount to save every month. Even a small amount is powerful when done consistently.

Saving benefits:

- Builds financial discipline

- Creates future investment opportunities

- Helps reach personal goals

Increase Savings Gradually

As income grows:

- Increase savings slowly

- Avoid sudden lifestyle upgrades

- Keep savings as a priority

Consistency matters more than amount.

Step 5: Choose Low-Risk Investment Options

You do not need risky investments to grow wealth.

Understand Low-Risk Investing

Low-risk investments focus on:

- Stability

- Long-term growth

- Capital protection

They may grow slower, but they protect your money.

Examples of Low-Risk Investment Choices

Depending on your country, common options include:

- Government bonds

- Fixed deposits

- Retirement savings plans

- Index funds with long history

Always understand before investing. Never invest money you need soon.

Step 6: Think Long-Term, Not Short-Term

Wealth is built over time, not overnight.

Avoid Quick Profit Traps

Promises of fast money often come with high risk. Many people lose money by chasing trends without knowledge.

Long-term thinking:

- Reduces emotional decisions

- Lowers financial stress

- Increases success chances

Patience is a powerful wealth tool.

Step 7: Increase Your Income Safely

Growing income helps build wealth faster without risk.

Improve Skills and Knowledge

You can increase income by:

- Learning new skills

- Improving existing abilities

- Taking professional certifications

Better skills usually lead to better pay.

Explore Safe Side Income Options

Low-risk side income ideas:

- Freelance work

- Online services

- Teaching or consulting

Extra income can be saved or invested, speeding up wealth building.

Step 8: Protect Your Money With Proper Planning

Wealth is not only about earning and saving. It is also about protection.

Importance of Insurance

Insurance protects against large financial losses.

Basic protection includes:

- Health coverage

- Life coverage (if family depends on you)

This prevents your savings from being wiped out by unexpected events.

Step 9: Avoid Emotional Financial Decisions

Emotions can damage financial progress.

Common Emotional Mistakes

People often:

- Spend impulsively

- Panic during market changes

- Copy others without understanding

These actions increase risk.

Stay Calm and Informed

Good financial decisions:

- Are based on logic

- Follow a clear plan

- Avoid pressure and fear

Staying calm protects your money.

Step 10: Review and Adjust Your Plan Regularly

Life changes, and so should your financial plan.

Check Progress Yearly

At least once a year:

- Review savings

- Review expenses

- Review goals

This keeps your plan realistic and effective.

Adjust Without Stress

If income changes or expenses rise:

- Adjust savings gradually

- Avoid panic decisions

- Stay consistent

Flexibility helps long-term success.

Common Myths About Building Wealth

Myth 1: You Need a High Income

Reality: Many people build wealth with average income using discipline and planning.

Myth 2: Risk Is Necessary

Reality: Wealth can be built safely with low-risk strategies and patience.

Myth 3: Only Experts Can Invest

Reality: Simple investment options are available for beginners.

Why Low-Risk Wealth Building Works Best

Low-risk strategies:

- Protect your money

- Reduce stress

- Encourage consistency

- Support long-term growth

They may not be exciting, but they are effective.

Final Thoughts

Building wealth step by step without taking high risks is possible for anyone. You do not need shortcuts. You need discipline, patience, and smart planning.

Start small. Stay consistent. Avoid unnecessary risks. Over time, these small steps create strong financial stability and long-lasting wealth.

The key is not how fast you grow, but how safely and steadily you move forward.