Managing money is not only about earning more. It is also about using money wisely, protecting it, and helping it grow slowly over time. This is where wealth management plays an important role.

Many people think wealth management is only for rich people. This is not true. Wealth management can help anyone, even beginners with small income, if it is done in the right way.

In this article, you will clearly understand what wealth management is, how it works, and how it helps you grow money in the long term. Everything is explained in very simple language so anyone can understand.

What Is Wealth Management?

Wealth management is a planned way of managing your money so it can grow safely over time.

It includes:

- Saving money

- Investing money

- Managing expenses

- Planning for future goals

- Protecting money from risks

In simple words, wealth management helps you make smart decisions about your money today so you can have a better financial future tomorrow.

It focuses on long-term growth, not quick profits.

Why Wealth Management Is Important

Without a plan, money can easily be wasted. Many people earn well but still face financial stress. This usually happens because there is no proper money management system.

Wealth management is important because it helps you:

- Control your spending

- Build savings regularly

- Grow money step by step

- Prepare for emergencies

- Plan for retirement

It gives direction to your money instead of letting money control you.

Wealth Management Is Not Only for Rich People

A common misunderstanding is that wealth management is only for wealthy individuals. In reality, wealth management is more important for people with limited income.

If your income is small:

- You must avoid mistakes

- You must plan carefully

- Every decision matters

Wealth management helps you use limited resources in the most effective way possible.

Main Parts of Wealth Management

Wealth management has different parts that work together. Each part has a clear purpose.

1. Saving Money Regularly

Saving is the foundation of wealth management.

Saving means:

- Setting aside a part of income

- Keeping money for future needs

- Creating financial safety

Even small savings matter. Saving regularly builds discipline and financial confidence.

A good habit is to save before spending, not after.

2. Smart Investing for Long-Term Growth

Investing means putting money into options that can grow over time.

Wealth management focuses on:

- Long-term investments

- Lower risk strategies

- Consistent growth

It does not promote fast or risky returns. Instead, it encourages patience and balance.

Long-term investing helps money grow slowly but steadily.

3. Managing Expenses Wisely

Wealth management teaches you how to:

- Track spending

- Avoid unnecessary expenses

- Spend according to income

Smart expense control does not mean living poorly. It means spending with purpose.

When expenses are controlled, more money is available for saving and investing.

4. Setting Clear Financial Goals

Goals give direction to money.

Wealth management helps you plan for goals like:

- Buying a home

- Children’s education

- Business plans

- Retirement

When goals are clear, money decisions become easier.

5. Risk Management and Protection

Life is unpredictable. Wealth management prepares you for unexpected events.

This includes:

- Emergency savings

- Insurance planning

- Avoiding high-risk decisions

Protection ensures that one bad event does not destroy years of financial effort.

How Wealth Management Helps You Grow Long-Term Money

Wealth management is focused on long-term success, not short-term excitement.

Here is how it helps money grow over time.

Encourages Consistency

Small actions repeated over many years create big results.

Wealth management promotes:

- Regular saving

- Regular investing

- Steady progress

Consistency is more powerful than sudden large actions.

Reduces Financial Stress

When money is planned:

- You worry less

- You feel more secure

- You avoid panic decisions

Peace of mind is a major benefit of wealth management.

Helps Avoid Costly Mistakes

Without planning, people often:

- Overspend

- Borrow unnecessarily

- Make risky investments

Wealth management helps you think before acting, which protects money.

Builds Financial Discipline

Discipline is key to long-term wealth.

Wealth management builds habits like:

- Budgeting

- Goal tracking

- Controlled spending

These habits slowly improve financial stability.

Supports Sustainable Growth

Instead of chasing fast profits, wealth management focuses on:

- Stability

- Balance

- Long-term value

This approach is safer and more reliable over time.

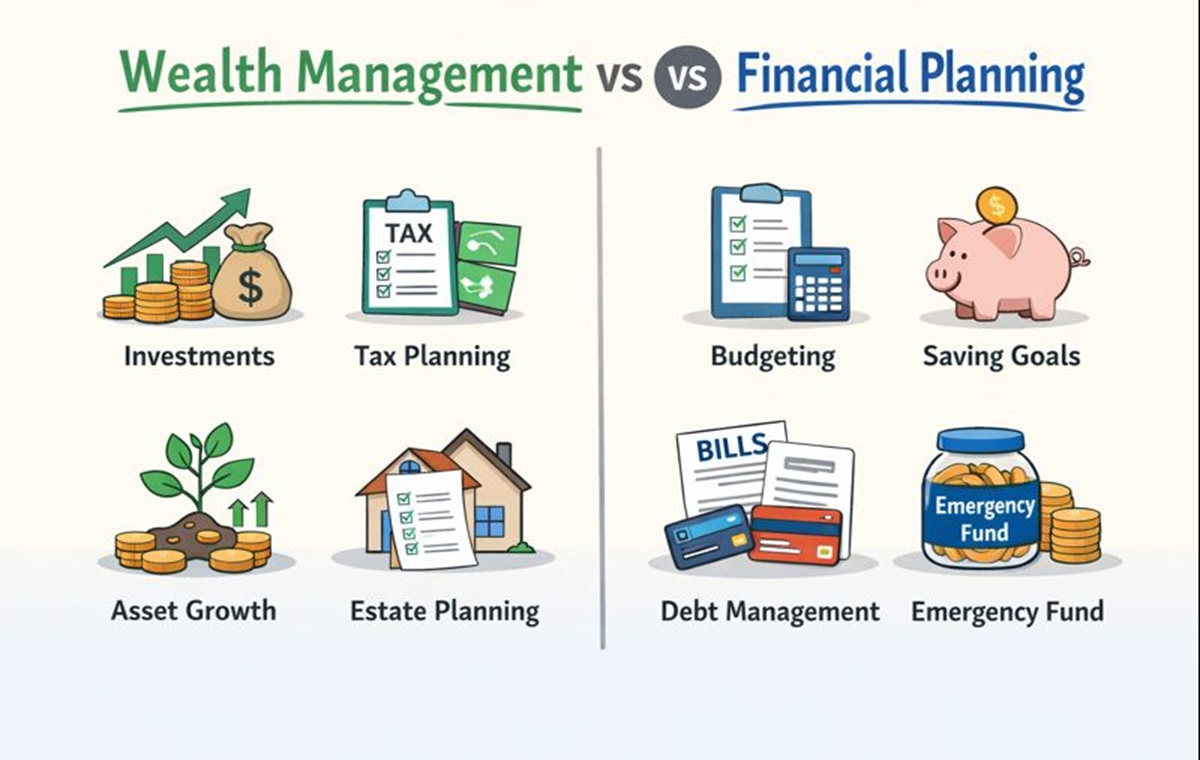

Wealth Management vs Financial Planning

Many people confuse wealth management with financial planning.

Financial planning focuses on:

- Budgeting

- Short-term goals

- Income management

Wealth management is broader. It includes:

- Financial planning

- Investing

- Risk management

- Long-term strategies

Both work together, but wealth management covers the bigger picture.

Who Should Use Wealth Management?

Wealth management is useful for:

- Working professionals

- Small business owners

- Freelancers

- Families

- Retired individuals

Anyone who wants financial stability and growth can benefit from it.

You do not need large income to start. You need clear thinking and patience.

How to Start Wealth Management as a Beginner

Starting wealth management does not have to be difficult.

Here are simple steps.

Step 1: Understand Your Income and Expenses

Know:

- How much you earn

- How much you spend

- Where money goes

This creates awareness.

Step 2: Create Simple Financial Goals

Set goals that are:

- Realistic

- Time-based

- Clear

Goals guide decisions.

Step 3: Start Saving Consistently

Even small amounts matter.

Consistency is more important than size.

Step 4: Learn Before Investing

Do not rush.

Understand:

- Basic investment concepts

- Risks involved

- Long-term benefits

Education protects money.

Step 5: Review and Improve Regularly

Life changes. Income changes. Goals change.

Wealth management should be reviewed regularly.

Common Wealth Management Mistakes to Avoid

Avoiding mistakes is as important as making good decisions.

Common mistakes include:

- No clear goals

- Overspending lifestyle

- Ignoring savings

- Taking unnecessary risks

- Lack of patience

Wealth grows slowly. Expecting quick results often leads to losses.

Wealth Management and Long-Term Financial Freedom

Wealth management is not about luxury. It is about freedom and security.

Long-term benefits include:

- Better control over money

- Reduced dependency on debt

- Improved financial confidence

- Prepared retirement life

It gives you the power to make choices without constant money pressure.

Final Thoughts

Wealth management is a smart and responsible way to handle money. It is not complicated and it is not limited to rich people.

By saving regularly, spending wisely, planning goals, and focusing on long-term growth, wealth management helps you build a stable financial future.

You do not need to start big. You only need to start right.

With patience and consistency, wealth management can slowly turn small efforts into meaningful long-term results